Trump's Financial Realities

Trump has long bragged he is a billionaire many times over.

Trump testified under oath less than a year ago that he had “substantially in excess of $400 million in cash.”

Trump lawyer Alina Habba said that he is worth “billions and billions and billions of dollars” and “happens to have a lot of cash.”

Trump must find enough cash to stave off asset seizures while he appeals judgments against him totaling at least $537 million.

As the 30-day time clocks for posting cash or bond wind down in the Carroll and New York cases, Trump has yet to post cash or bond.

Trump offered a New York appeals court a bond of only $100 million while he appeals. The Court rejected that offer and said Trump must provide the full amount.

In a court filing regarding the NY judgement, Trump said that to secure the full $454 million, he would probably need to sell properties at fire-sale prices.

With big commercial buildings, sales typically take months to close, even with a willing buyer and seller. If Trump's buildings are to be his source of cash, they would have to be hugely discounted, and major concessions would need to be made to secure a near-instant sale.

Trump has owned most of his properties for years so if he is forced to sell, he could incur a big tax bill.

Any sale would have to be reviewed by the Trump Organization’s court-appointed monitor, retired judge Barbara Jones

It is unknown how leveraged Trump's buildings are. If they are encumbered with first, second, or third mortgages, the lenders would be automatically involved and that would slow a sale or make it impossible.

Unless the appeals court cuts him a break, Trump would have to post cash or a bond in the full amount, plus an additional percentage to account for interest.

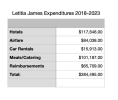

If Trump does not post cash or bond, AG James and Carroll will move quickly to seize some of his assets.

Trump’s lawyers have said they plan to seek a bond, rather than post cash.

An appeal bond is a guarantee filed with the court by a financial institution that promises that a judgment will be paid.

Appeal bonds are risky, and a company providing one would be on the hook for the full amount if Trump loses.

With Trump's weak legal arguments, it is likely that Trump will lose his appeals, and prospective bonding companies know that.

Defendants usually pay steep fees to bonding companies, and must provide collateral for the full amount.

Bonding firms usually require cash, stocks and bonds: things that can be liquidated quickly.

In New York, a defendant also owes 9 percent interest until the judgment is paid or the appeal resolved. That is added to the size of the bond.

This interest accrues daily and adds over $4 million a month to the judgements that must be paid.

Trump owns a stake in Trump Media & Technology Group, which could be worth as much as $3 billion (at today's stock price) if a long-delayed merger closes this month.

Trump’s shares in this company are subject to a six-month lockup period after the merger, and come with market and other risks, making them unattractive collateral.

Some of the parties involved in this merger are fighting each other in court. That could further delay the merger.

The time clock in the NY case runs out on March 25.

The time clock in the Carroll case runs out March 9.

The above info comes primarily from this

NY Times article.

www.nbcchicago.com