It's a Team's Life

Keep track of those miles...

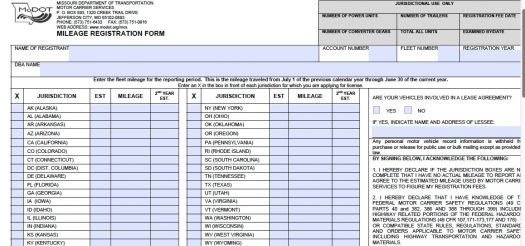

In our situation there are three ways to get the miles driven in each state listed from best-case scenario to worst case scenario:

Write down mileage each time a state border is crossed

We are provided with a fuel tax report each month - track miles from here

Ask carrier for a list of miles driven in each state

With our carrier when we ask for a list of miles driven in each state. The information we receive will be a list of dispatched miles including dead head miles and loaded miles. This report is lacking any unauthorized dead head miles.

The fuel tax report we receive each month with fuel tax (IFTA) due in each state is from the pings sent to the Qualcomm unit in our truck. These miles will include dead head miles and miles driven for personal use.

Both IFTA and IRP require reporting of all qualified vehicles:

Having two axles and a GVW of 26,000 lbs.

Having three or more axles regardless of weight

This does not include recreational vehicles, farm vehicles, city pickup and delivery vehicles, buses used in transportation of chartered parties, or government owned vehicles.

Electronic Recording Systems

For tax reporting purposed, on-board recording devices, vehicle tracking systems, or other electronic date recording systems may be used instead of or in addition to handwritten trip reports.

Recordkeeping Reminders

Keep IFTA records for four years

Keep IRP records for 3 years

Save fuel receipts

More information available:

Bob & Linda Caffee

TeamCaffee

Saint Louis MO

Expediters 8 years been out here on the road 13 years

Expediting isn't just trucking, it's a lifestyle;

Expediting isn't just a lifestyle, it's an adventure;

Expediting isn't just an adventure, it's a job;

Expediting isn't just a job, it's a business.