In The News

November 2013 Syleconomics - Closing out 2013 and looking ahead to 2014

November 2013 vs. November 2012: November 2013 and November 2012 has one fewer (5% fewer) business days, so the 9% year over year volume growth is really more like 13-14% year over year growth. Last year could have been negatively impacted by Hurricane Sandy that hit the Northeast around October 26 and the impact was felt on the East coast well into November last year. The good news is that the Sylectus companies realized a healthy increase in both load counts and revenues on a year-over-year basis. Rate per mile is only slightly below last year and has been very stable for the past 6 months.

So, all in all, November 13 shows a very good growth bump over November 12. Capacity numbers are showing a relative stability but we have yet to reach 2007 levels. Trucking will shortly head into a traditional “slow period†(Christmas through to early February), so the lean capacity number is probably a good thing. We suspect that companies will ramp up recruiting efforts in late January and early February to prepare for the 2014 shipping demands. See charts below for more information.

Good news—this is the 6th month in a row where we see year-over-year revenue growth and volume. We continue to see some decent year-to-date 2013 over 2012 growth after stagnant or no growth for the first half of the year.

November 2013 versus October 2013: November 2013 had four fewer (20 percent fewer) business days compared to October 2013, so the business decrease of 13% shown in the tables below should really be more like a 5-7% increase if adjusted for business days. November is usually a slower month due to the holidays, so the November numbers coming in (adjusted for business days) as better than October can be seen as good news. The first few days of December show a relatively strong continuation of the November numbers.

The

year-to-date figures show that business volumes are running a bit above last year.

Due to the stronger past several months (June — November) business volumes and revenues are now tracking at or above 2012 numbers, but

rates are still slightly behind last year—which appears to be a common theme.

Capacity is continues to lag and has still not reached 2007 levels. Again, we are finally seeing rates start to creep back to the 2011 and 2012 levels.

Truck Searches and Load Postings: These numbers have retracted a bit in the last 30-40 days, down from the peaks we saw in September. The Load Postings set a record just prior to the Thanksgiving holiday.

Below, is a breakdown of the metrics: (Note: To be included in the data analysis, companies had to be on our system for all reporting periods – consider this the “same store†concept)

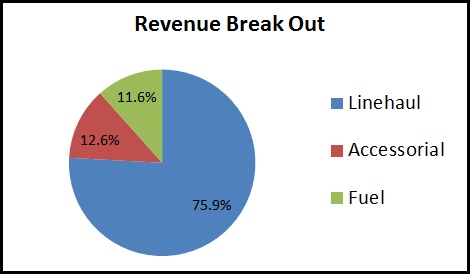

Breakout of Revenue by Type:

In the above table, we show changes in TOTAL revenue and then the changes in the components of total revenue (line-haul, fuel and accessorial). Below, is the breakout by percentage of revenue.

Line-haul revenue represents 75.9% of the total revenue

Fuel revenue represents 12.6% of the total revenue

Accessorial revenue represents 11.6% of the total revenue

Syleconomics commentary

The well-documented collapse of the housing market in 2008-09 that sent the world into an economic tailspin is well behind us, but the damage from that financial storm is still felt in many parts of the world and affects the current fiscal growth rate throughout North America. A great current article on the economic forecast for 2014 can be found at http://www.kiplinger.com/tool/business/T019-S000-kiplinger-s-economic-outlooks/.

I am not an economist, so I will not make any economic predictions for 2014 transportation companies. I will, however, share some technology plans that will help Sylectus subscribers in 2014.

About Sylectus

Sylectus is trucking’s most powerful network. Born in the new, cloud-based economy, it’s built on one simple idea … leverage the resources of your competitors to achieve extraordinary results for

your customers and for

your company.

Sylectus is more than Transportation Management Software. It’s a

web-based, protected, wealth creation network for managing in the New Trucking Economy. Designed exclusively for

progressive trucking companies,

Sylectus enables them to bypass the investment and time continuum to grow fast

NOW.