In The News

January 2014 Syleconomics

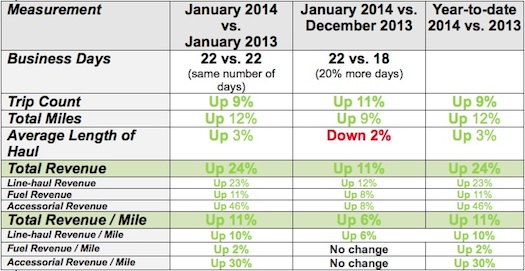

January 2014 was a the best start to the year ever and it continued the momentum we saw as 2013 ended! January 2014 had the same number of business days as January 2013, and managed a

whopping 24% revenue jump over the same period last year with only a 9% increase in loads. So January actually saw a significant increase in rates. January 2014 saw a continuation of the severe weather situations that began in December. Blizzards, extreme cold and other weather related factors affected capacity and schedules, which put a strain on available drivers/trucks and upward pressure on prices. Also, unlike January 2012, no fiscal cliff issues (like last year) and a strong stock market (although the stock market has cooled in the past few days). This is, by far, the strongest January we have recorded which follows on the heels of one of the strongest Decembers we have ever recorded. Companies usually look to come out of January with “break even†or “minor lossesâ€. We suspect that many companies exited January with a great start to the year. What is very exciting is that revenue per mile is at an all-time high, and the majority of that increase is in linehaul (fuel remained stable and accessorial remained fairly stable from December to January). All in all, it was a great way to start 2014!

Capacity numbers are showing a relative stability but we have yet to reach 2007 levels. Trucking is now in a traditional “slow period†(January through to early February), so the lean capacity number combined with the weather-related impact on capacity has spiked prices. See charts below for more information.

Good news—this is the 8th month in a row where we see year-over-year revenue growth and volume. We started 2014 much stronger than we ended 2013 after stagnant or no growth for the first half of 2013.

January 2014 versus December 2013: January 2014 had four more (20 percent more) business days compared to December 2013, so the business increase of 11% shown in the tables below should really be more like a 7-8% decrease if adjusted for business days. January is usually a slower month and after adjusting for business days, makes it look pale in comparison to December. But December 2013 was a strong month, so the January numbers coming in (adjusted for business days) as below a good December is not an issue. What is really impressive is how the rate-per-mile has jumped in January – the best rate-per-mile on record.

The

year-to-date figures (to start off 2014) match January data. See comments above.

Capacity continues to lag and has still not reached 2007 levels. Lower capacity will put continued stress on rate per mile.

Truck Searches and Load Postings: Both charts show a healthy growth in 2014. The load posting has had a surprising start for the first month of 2014. Again this is reflecting the capacity crunch as companies look for creative ways to cover excess freight.

Below, is a breakdown of the metrics: (Note: To be included in the data analysis, companies had to be on our system for all reporting periods – consider this the “same store†concept)

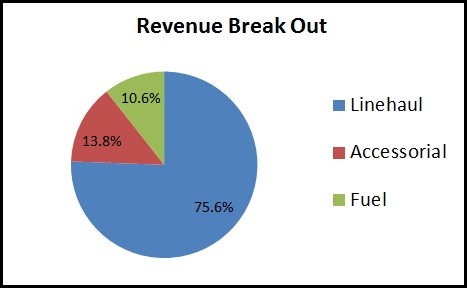

Breakout of Revenue by Type:

In the above table, we show changes in TOTAL revenue and then the changes in the components of total revenue (line-haul, fuel and accessorial). Below, is the breakout by percentage of revenue.

Line-haul revenue represents 75.6% of the total revenue

Fuel revenue represents 10.6% of the total revenue

Accessorial revenue represents 13.8% of the total revenue

Syleconomics commentary… A small uptick in business and a shortage of trucks means...

Two years ago I bought a new vehicle that came with some amazing safety sensing technology. The vehicle would automatically adjust to the speed of a slower vehicle in front of me, to prevent me from inadvertently crashing into a slower vehicle while on cruise control. It also had all sorts of lights and sirens warn me if I was potentially going to hit something that was turning in, or out, of my path. Since purchasing that vehicle, I have read articles about “driverless vehicles†that will someday allow a convoy of trucks to travel 65 miles per hour only 3 yards between the bumper of the leading truck and the hood of the following truck. The vehicles would be electronically tethered to each other by an invisible communication link, truck talking to truck, all in sync with the lead vehicle. Scary!?!?? But true.

Why is it scary? Well, I live in a cold climate and while driving in severe conditions, my wonderful, smart, collision-sensing equipment will tell me it is inoperable due to sensors being covered with snow (or mud or whatever).

The reality of a driverless convoy of trucks (known as platooning) is probably still decades away. But I mention this concept because the need to find solutions to the driver shortage is growing. The average age of the driver is increasing, the driver has not seen a reasonable increase in wages for years, it is not a preferred lifestyle for many of the new generation workers (especially those that want a family home life) and, to top it off, continues to be scrutinized and constrained by lawmakers (all for good reasons).

History and economics show that when a labor pool (resource) becomes scarce, the price of that resource will go up. And we are seeing that in our monthly numbers. But the driver shortage is not a new phenomenon. Prior to the last recession, there was already talk of a driver shortage. The recession calmed those fears as demand dwindled in 2008 through 2010. But since 2011, demand has slowly increased to the point where quality drivers are the key to the success of any growing trucking company. Capacity has become so tight, that only a small blip in demand can have a significant impact capacity and subsequently on prices. This is what we have seen in December and January as weather related issues impacted available capacity. The weather will get better and prices will probably come down a bit as equilibrium is restored into many supply chains.

But this recent price-blip should be a warning to all transportation executives of what to expect if a true demand spike occurs. For example, what would happen if new house building suddenly increased? It has been said that a new house requires anywhere from 8-14 truckloads of product, material and supplies. A boom in the house building industry will put additional strain on an already tight truck capacity issue.

So what does this recent capacity issue mean?

Trucks rule! Companies with trucks (actually, trucks with drivers) will have more control on pricing. Logistic companies, pure brokers and other transportation plays that do not have their own capacity will be at the mercy of the actual trucking companies to provide capacity at a reasonable rate. If contracted rates are not locked in, trucks (drivers) will go to the highest bidder.

No more middle man??? Shippers may find that they will get better results dealing directly with asset-managing carriers rather than non-asset organizations (sort of “cutting out the middle manâ€). This is a way to get access to much needed capacity at a reduced or consistent rate

Positions of Strength. Carriers with both trucks (drivers) and brokerage capability will be able to supplant brokerage houses by becoming the “one stop shop†for their shippers. Furthermore, access to additional capacity in real time (like belonging to the Sylectus Alliance and doing business via Virtual Fleet) will give these carriers capacity and automation to capture this market opportunities.

Driver rates rising. The lowest common denominator in the capacity game is a driver. Trucking companies will come up with innovative ways of finding, hiring and retaining their best drivers. There are all sorts of gimmicks out there, but in the end, money talks. A portion of the raised rates will go to the driver pool.

Technology for the driver. We are still decades away from the concept of “platooning†(mentioned above), but that doesn’t stop companies from providing innovation and technology in the cab to make the driver life easier, safer, less stressful and more comfortable.

What we see in the Sylectus data is supporting the capacity crunch theory:

More load postings. Capacity is already tight, so if drivers and/or trucks go out of service due to weather situations, the load is posted out to the network for coverage. January, a typically slow month, saw a record number of load postings.

Higher price per mile. Again, capacity is tight. So carriers have been charging a premium to have their drivers work in these conditions. January saw the highest rate per mile … ever … in our system. This is very unusual for January.

More air freight and air charter. Shippers will sometimes pay to fly the freight over the bad weather than drive it through the bad weather.

In the charts below, you will see a spike in Accessorial rate per mile in December and January. This is typically air freight charges.

Don’t forget to build your network of trusted trucking companies:

The coming months will continue to see swings in shipper demands.

The Sylectus Alliance offers your business “variable capacityâ€. The alliance is a collection of hundreds of trucking companies and thousands of trucks across the continent. The smart members of the Alliance build strong,

TRUSTING business relationships with other Alliance members. These business relationships help each member survive the bad times (recessions) and quickly grow during the good times (quick access to quality, trusted, available trucks). Even smarter carriers subscribe to the Sylectus AlliancePro software with Virtual Fleet that automatically and seamlessly integrates you with thousands of trucks, hundreds of qualified dispatchers and a continent wide sales force. Attend the Sylectus (www.sylectus.com) and TEANA (www.teana.org) network events to build and nurture your business relationships within the Alliance.

Business is good right now. Shippers in certain geographic areas are willing to pay great rates to get their products shipped. Now would be a great time to:

Balance your business (raise rates and cull you questionable customers);

Build/enhance/nurture your network of Alliance partners;

Implement programs to find, hire and retain the best drivers.

Focus on freight that pays delivers the best return and share that additional revenue with your driver workforce;

Build your strong team;

Keep your debt low;

Invest in the best technology to drive your business forward (oh … another shameless plug). If any of you want to find the best technology, we invite you to ask any of our AlliancePro customers about our award winning dispatch, billing, payroll, imaging, fleet management (and much more) software.

About Sylectus

Sylectus is trucking’s most powerful network. Born in the new, cloud-based economy, it’s built on one simple idea … leverage the resources of your competitors to achieve extraordinary results for

your customers and for

your company.

Sylectus is more than Transportation Management Software. It’s a

web-based, protected, wealth creation network for managing in the New Trucking Economy. Designed exclusively for

progressive trucking companies,

Sylectus enables them to bypass the investment and time continuum to grow fast

NOW.