Dollars & Sense

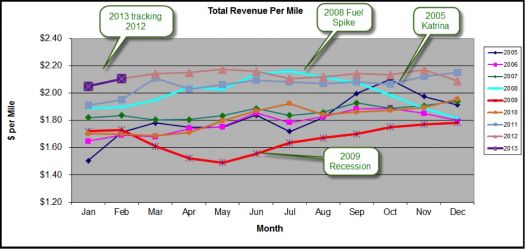

Syleconomics - business rebounding slightly ... but line-haul rate per mile is still not as good as 2012

For past issues of Syleconomics go to www.sylectus.com and see the “

Hot News†section.

February 2013 vs. February 2012 had the one fewer (5%) business days, so the 3% increase in trip count and 5% increase in revenue is a refreshing year over year increase. If we factor in the fewer business days, the business volumes were higher than shown in the table below. However, we continue to see “year over year†rate erosion. The total revenue is up, but most of this increase is due to higher fuel surcharge revenue and companies supplementing their revenue using accessorial charges. Trucking companies are finding additional revenue streams via accessorial charges like reduced wait times and insurance surcharges.

The February 2013 vs. January 2013 had the two fewer (10%) business days, so the decrease in business (month to month) is easily offset by the variance in business days. January 2013 had about 10% more business days compared to February. It is refreshing to see line-haul rate/mile inch upwards, reversing the downward trend we have seen in the past several months and is more a seasonal upswing rather than a general trend.

Capacity is going back down.

IMPORTANT! We noticed that capacity almost reached 2007 levels but has slowly retracted over the past few months (see chart below) and dropped again in February. The driver shortage may become a huge issue this year. A key force in driver shortage this year could be the rebounding housing market. As housing construction increases, drivers may opt to leave their cab and the long days away from home for the comfort of a local construction job. The capacity chart is shown below. If driver shortage becomes an issue (capacity), it will have an upward influence on rates.

Syleconomics commentary … The speed of trust … how can improved trust grow your business?

In his book

The Speed of Trust, Steven R. Covey explains that “Nothing is as fast as the speed of trust. When trust is low, speed goes down and cost goes up. When trust is high, speed goes up and costs go down.â€

This is so true in the Alliance. I have witnessed the speed of “high trust†while sitting in a dispatch office a few years ago. A dispatcher was on the phone with a shipper needing to move freight from A to B. The dispatcher did not have a truck near A, but explained to the shipper that he had a “trusted†carrier partner nearby (he used the “Closest Truck Searchâ€) that could handle the shipment with the same quality service. The dispatcher took the load and immediately dispatched it to one of their trusted partner carriers.

I asked the dispatcher: “

Are you going to call your partner carrier to ensure the truck is still there and available?†His response astounded me.

He said: “

No. I know they keep their trucks current and they know that if I ‘VF’ a load to them, and they don’t have an available truck, they will call me. And they rarely call me to turn it back. Besides, if they turn it back, the system showed me several other of my best partner carriers nearby that could also do the job.â€

I then asked: “

But what about the rate?"

He said: “

We have a mutual rate agreement in place. He trusts that we will be fair and I trust that they will be fair. We both make money.â€

When trust is high, speed goes up and costs go down!

The speed at which this dispatcher could book business and move on to his next task was increased due to the incredible trust he had established with his carrier partner and his shipper. Information at his fingertips (truck availability by trusted partner carrier) and the trust between him and his shipper (his shipper agreed to let him broker the load) and the trust between him and his partner carrier, allowed him to complete a transaction with minimal effort. Higher productivity. Lower cost. Fast. Efficient. The power – and speed – of trust!

For those of you who have read this far, I challenge you to go into your dispatch areas and see the effort it takes to broker a load to a partner carrier. If the levels of “trust†are low, chances are you will see:

Your shippers will be reluctant to allow you to broker loads. They don’t want to lose control by introducing a carrier they have no direct relationship with.

Your dispatchers will need to call the partner carrier to verify truck availability, even though the truck may show as available on the system.

Your dispatchers will need to verify rates with partner carriers and perhaps even require supervisory approval on rates before moving forward.

For more information on

The Speed of Trust by Steven R. Covey, see http://www.johnmcgeelive.com/?p=11.

Last month Sylectus launched a new tool for all Pro/VF accounts where they could measure and rate their trading partners within the Alliance. How they rated other members of the Alliance will be available in various screens like “Closest Truckâ€, “Posted Loadsâ€, “Dispatchâ€, etc. to make it easier to know which Alliance partners you

trust the most,

perform the best and

pay the best.

Why did we introduce this new tool?

Over the past several years we have noticed the companies that succeed the most in the Alliance have three commonalities. There is a high level of

TRUST in what they do. They

PERFORM consistently at a high level. They

PAY THEIR BILLS promptly. These three attributes are the secret sauce of succeeding in transportation. If members can exceed in these three categories, they will be very successful in the Alliance.

How does this new survey work?

This is only for Pro/VF companies on the Sylectus program. Once a quarter, selected members of Alliance companies will be notified by e-mail that the Trust Survey is “openâ€. They will be asked to complete the “Trust Survey†to store their data and also to receive their own rankings.

The system will show them all the companies you worked with for the prior quarter. It will show them, for each trading partner, how many loads they brokered to their trading partners and how many their trading partners brokered to them. They can score them on three rankings:

Trust: How much do they trust this carrier? Would they give them a load from their best customer? Did this partner ever back-sell them? Did this partner ever recruit one of their drivers? If they have an issue, do they feel like I have a direct line to management / ownership to get it resolved? If the partner made a mistake, did they take responsibility or misrepresent the truth to hide their failure? Etc.

Performance: How did the partner perform at picking up or delivering "on time"? How well did they communicate during the life of the trip? Do they have 24/7 dispatch and availability if you need to contact them? Are they a VF member and is tracking automatic or manual? Did we have any service failures with them?

Payment: Did they pay their freight bills in a timely manner (according to their payment terms)? Do they constantly have to be chased to get paid?

Participants will also be able to anonymously provide each carrier with “one good thing they do†and “one thing they could do to improve your business relationships.†Again, these comments will be delivered to your partner carrier anonymously.

What will companies get out of completing this quarterly survey?

Sylectus will take the results of all the surveys and provide Alliance

subscribers with their average and ranking of how other carriers

perceive them. For example, their numbers could be as follows:

Category

Average

Rank

Trust

7.7

13 out of 128

Performance

8.4

8 out of 142

Payment

5.6

92 out of 135

They will NOT know how other companies rank them individually, but they will get an average and a rank-position value. They will also get any anonymous feedback text others have provided.

The reaction of Alliance members to the “Trust Survey�

The feedback Sylectus has received about the first trust survey is mostly positive.

The companies in the top 10 are very happy and most want to shout their accomplishment from the rooftops (and they should be proud!).

Companies that did not finish in the top 10 are reviewing their results. Some have contacted me directly to understand the numbers better and discuss how they can improve their rankings. This survey is done quarterly, so they are looking to improve their position and ranking by adjusting their business policies.

There were a few companies who did not complete the trust survey. Their ratings were obviously not included in the published results.

What is the value of this “Trust Survey�

This is valuable peer feedback to tell Alliance members how others within the network perceive their business. If members are serious about growing their business, then this survey will provide them with quarterly, unbiased information on how their company is perceived in the Alliance. Smart, progressive owners/managers will use this information to better their organizations.

What will smart companies do with this information?

Improve their level of trust in the network. Work with your staff to build trust. A good start is to attend meetings of Alliance members (either a Sylectus hosted meeting or a TEANA meeting). The next events are Wednesday, February 10th in Philadelphia, PA and Monday, April 29th in Cincinnati, OH. For more information, go tohttp://www.sylectus.com/sylectus/events/Spring2013/. Perform at your highest level. Build strong processes so your business delivers top-notch service and results. Keep your truck postings current! If your truck postings are not current, Alliance members will not trust your information. Use the suggestions from the Trust Survey to better your business. Pay promptly. Give your team the best tools. The best computers, the best phones, the best chairs, the best software, the best business partners, the best communication devices. Integrate your network. (Here comes the shameless plug). Get the Sylectus AlliancePro software with Virtual Fleet that automatically and seamlessly integrates you with thousands of trucks, hundreds of qualified dispatchers and a continent wide sales force. Attend the Sylectus and TEANA network events to build and nurture your business relationships within the Alliance. The next event is February 8-10 in Scottsdale, AZ. For more information, go to http://www.sylectus.com/sylectus/events/Scottsdale2013/. Supply/Demand analysis

2011 was the best year ever for many Sylectus customers. 2012 started out ahead of 2011, but the last 6 months of 2011 tracked with 2012. The first few months of 2013 are tracking closely with 2012. We see a particularly strong increase in our long-term customer base (customers with us for at least 5 years). The long-term customers have such a strong, well-established, trusted network within the Sylectus Alliance, that they have been able to leverage the Alliance capacity into higher business volumes.

Our SUPPLY-DEMAND index is comprised of a subset of our customers that have been on our system for a minimum of 6 years.

Capacity is going back down. We noticed that capacity almost reached 2007 levels but has slowly retracted over the past few months. A lower capacity number will push rates higher.

In contrast, the Dow Jones is now above the 2007 highs.

Total revenue per mile is a combination of

Line-haul revenue per mile accessorial revenue per mile Fuel revenue per mile

So what does this tell us?

Supply of trucks (capacity) continues to lag below demand and was slowly recovering but has reversed that trend in the past few months. It is back down below pre-recession levels. This could have an impact on rate per mile. The Demand (loads) is tracking better than 2007. 2010 and 2011 were great rides. 2012 started out ahead of the same period last year, but the last 6 months of 2012 tracked 2011. 2013 is tracking slightly ahead of 2012.

You still need to remind your operations staff to become "creative" when presented with load opportunities. Get them to use the software solution to:

Turn every load opportunity into an order Turn every order into repeat business Keep your drivers happy. Working together as a team (Alliance) can help weather any seasonal economic slowness and take advantage of the seasonal busier times (never saying "no" to a customer).

It just keeps getting better ... and the best is yet to come!

About Sylectus

Sylectus is trucking’s most powerful network. Born in the new, cloud-based economy, it’s built on one simple idea… leverage the resources of your competitors to achieve extraordinary results for your customers and for your company. Sylectus is more than Transportation Management Software. It’s a web-based, protected, wealth creation network for managing in the New Trucking Economy. Designed exclusively for progressive trucking companies, Sylectus enables them to bypass the investment and time continuum to grow fast NOW.