Risky Business

Understanding Owner Operator Phys Dam Insurance

Owner Operator, do you ever drive along and wonder "Exactly What IS Phys Dam?"

“Phys Dam” is short for Physical Damage.

Physical Damage is the Comp and Collision Insurance Coverage on your truck.

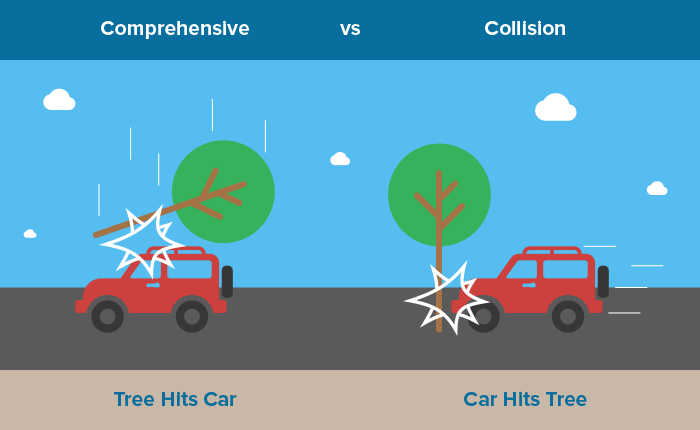

Collision insurance covers your truck if it is damaged by hitting something or overturns.

Comp is short for Comprehensive. This insurance covers just about anything else that can happen to your truck like fire, theft, vandalism, windstorm or animal hit.

(Fire and Theft is Comprehensive “light”…it does not include everything that Comprehensive can offer and is generally just used for Trailer coverage.)

The Stated Amount is the maximum Phys Dam amount your insurance provider will pay UP to in a claim. The duty to submit the true Stated Amount based on market value is on the Owner Operator. (Because it is not an “Agreed Value” policy, there is no point in over insuring your unit.)

However, if your unit is financed, several insurance providers offer "Financed Value Coverage" which will pay the actual cash value of your loan up to your Stated Amount.

Like all insurance, your credit greatly impacts your cost for Phys Dam. Rates can vary from a low of 1.7% up to 4% per thousand value.

If you are a Motor Carrier or Owner Operator with your own authority, then it’s likely you insure all of your units with one insurance provider for Liability, Phys Dam and Cargo…or at least one Truck Insurance Agent who has shopped various options for you.

If you are an Owner Operator without your own authority, then it’s likely you are offered a company plan by the Motor Carrier for whom you are hauling freight. Typical coverage offered to you is Non-Trucking Liability or Unladen Liability as well as Phys Dam.

As an Independent Contractor, you can choose options from your Motor Carrier’s company insurance menu, or purchase your own NTL or Phys Dam.

Because credit varies considerably from Owner Operator to Owner Operator, someone with credit confidence usually profits from shopping for their own insurance because the rate is based on YOU vs “the pool” in the company plan who may not share your credit expertise.

In fact, credit is so important that someone with a high valued vehicle and good insurance credit score can qualify for a lower insurance premium than someone with a lower valued vehicle but poor insurance credit score.

Other perks include more flexible options like lower down payments and balance stretched over many months.

Insurance credit scoring is here to stay whether we like it or not, but I’ve seen poor scores improve considerably within a year’s time. It’s best to understand how it could be negatively affecting you on all of your insurance vs wondering why the other guy with the same driving record got a better rate.

Shelly Benisch, CIC, TRS

Commercial Insurance Solutions Inc. (CIS)