Fuel for Thought

Fuel and IFTA

It is always important to a business owner’s success to control costs. You should spend what is necessary to run your business, but at the same time, do what you can to spend the least on expenses to keep more profit. With the current fuel prices being what they are, and the very real possibility of even more increases in fuel costs, it is even more crucial to get the most from your fuel dollars.

Using apps to find the lowest price on diesel is a great start, but don’t forget to factor in the IFTA fuel taxes. When searching for the lowest cost diesel, it is important to look at the raw fuel cost. The raw cost is the price you will pay minus the IFTA fuel tax. What may seem to be a good price in one state may not look so good when you compare across state lines with the fuel tax removed.

IFTA taxes are included with every gallon of diesel purchased, in every state, except Oregon. Your own IFTA tax liability will be determined by your truck’s miles per gallon and miles traveled in each state. Some states have additional mileage taxes that cannot be paid by purchasing fuel, however IFTA taxes are collected when you buy on road diesel fuel.

You can lower your fuel costs by getting better mileage. Cruise at a lower speed to cut fuel consumption when your schedule allows. Getting better miles per gallon will also reduce your IFTA tax bill since it is based on your MPGs and miles traveled. Higher MPGs means less fuel used, thus less taxes owed. Increasing your MPGs saves your business twice - at the pump and on fuel taxes.

Your IFTA tax is based on certain set criteria, MPG and miles traveled, therefore, you will owe the exact same tax whether you pay the tax at the pump or later. So why not buy the lowest cost per gallon diesel, not just by the pump price but also minus the tax?

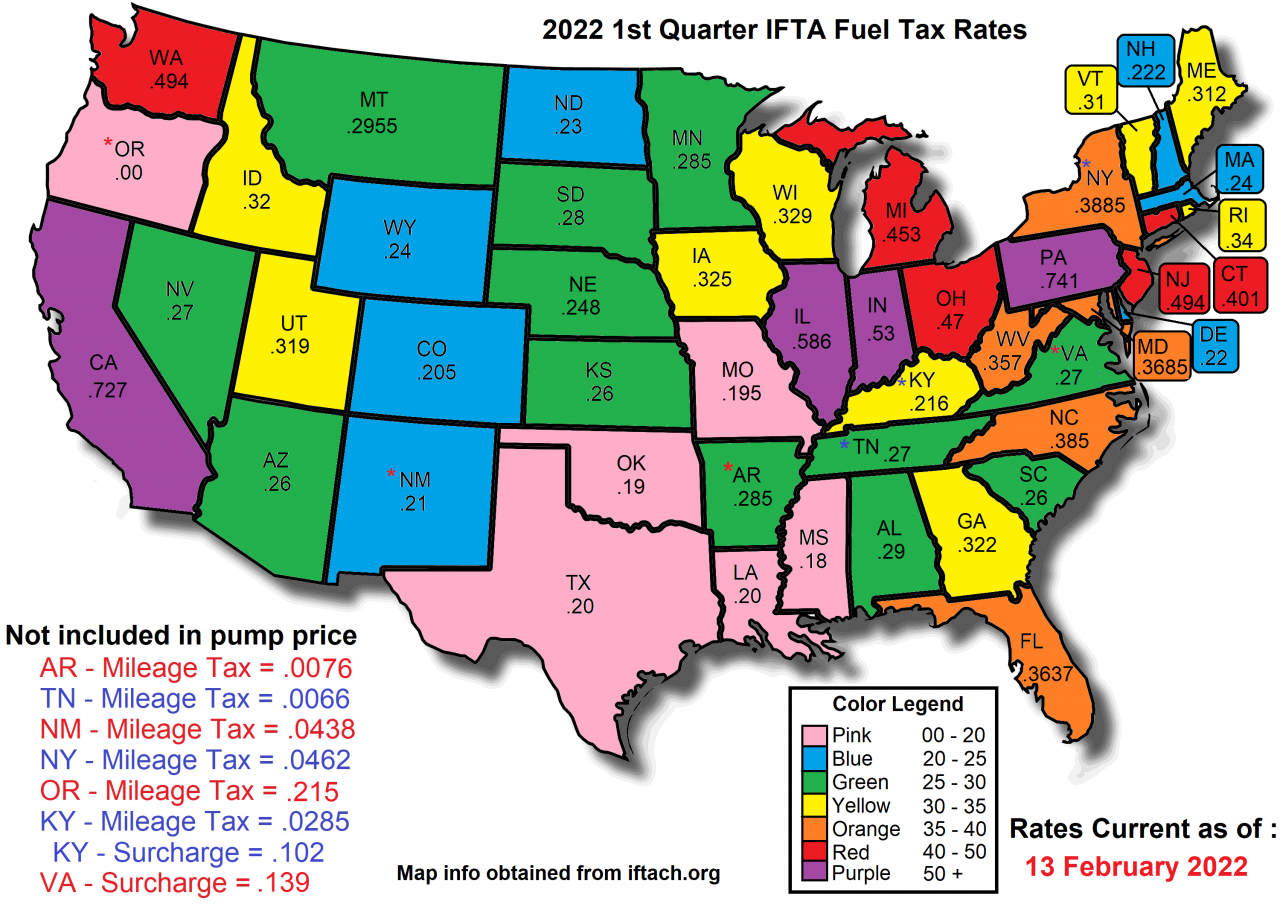

A few years ago, I created a fuel tax map. It is the exact same information found on the IFTA website for tax rates. I just put it into a visual form with color coded states to make it easy to look over and know the taxes in the states where you drive. I and many others found it useful for finding the lowest raw cost per gallon diesel fuel. The IFTA website has the same info, but in an alphabetical list. While it is easy to use, the states that border each other don’t always line up in alphabetical order so on the website you have to scroll back and forth to find the tax rate you are looking for. The map, on the other hand, makes it easy to move along your route to check tax rates. The map at the top of this article is the current one as of the posting of the article.

I do update the map monthly, or thereabouts, and post it on my Facebook page for anyone to use.

Whether you use the IFTA website, my fuel tax map or some other source to calculate the actual raw cost per gallon of diesel fuel, use it effectively to keep more of your revenue instead of wasting it on high priced fuel or additional fuel taxes.

See you down the road,

Greg