In The News

September 2013 Syleconomics - Business numbers continue to strengthen

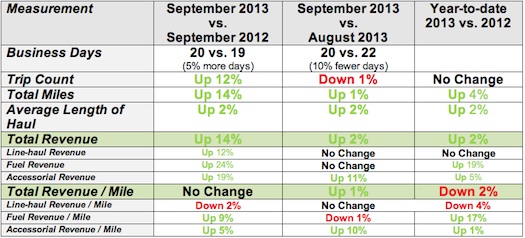

The September 2013 business figures showing stability in freight volumes but continued rate weakness.

September 2013 vs. September 2012: The numbers below need to be adjusted for business days. September 2013 had one more (5 percent more) business days (September 2013 had 20 business days versus September 2012 had 19 business days.) Taking this into account, September 2013 was about 7 percent stronger than September 2012. Line-haul rates continue to show some rebound and starting to push back to levels experienced in the past few years. Capacity numbers are showing a relative stability but we have yet to reach 2007 levels, as such, there should still be good upward pressure on rates as we head into the typically busier fall season. See charts below for more information.

Good news—this is the 4th month in a row where we see year-over-year revenue growth and volume. However, the concerning news is that the rates are still slightly below prior years.

September 2013 versus August 2013: September 2013 had two less(10 percent fewer) business days compared to August 2013, so the nominal increase shown in the tables below should be about 10 percent and not 1 percent. As such, September, once adjusted for business days, was better than August by about 10 percent. August was a relatively strong month, and the September numbers are even more impressive. The first few days of October showed a relatively strong continuation of the September numbers, but then the U.S. Government Shutdown appears to have taken a bit of the wind out of the sails--aka sales. Detailed results on the impact of the shutdown are outlined below, in a review of the customer survey.

Rate per mile is still a bit concerning considering the strong business volumes and muted capacity numbers.

The

year-to-date figures show that business volumes are running a bit above last year.

Due to a stronger third quarter (July— September) business volumes and revenues are now tracking at or above 2012 numbers, but

rates are still slightly behind last year—which appears to be a common theme.

Capacity continues to lag and has still not reached 2007 levels. Again, we are finally seeing rates start to creep back to the 2011 and 2012 levels.

Breakout of Revenue by Type:

In the above table, we show changes in TOTAL revenue and then the changes in the components of total revenue (line-haul, fuel and accessorial). Below, is the breakout by percentage of total revenue:

Line-haul revenue represents 75.9% of the total revenue

Fuel revenue represents 12.4% of the total revenue

Accessorial revenue represents 11.7% of the total revenue

Syleconomics commentary—The impact of the U.S. Federal Government Shutdown.

The U.S. Federal Government Shutdown may be over by the time this issue gets published (Congress is voting on it as I email this), but Sylectus did notice a drop in trip counts as the shutdown grew longer. We decided to do a quick survey of the Sylectus subscribers to gauge the business impact on the shutdown.

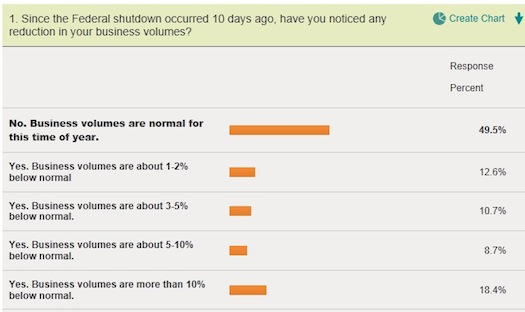

Below is my analysis of the feedback from our customers regarding the impact of the U.S. Federal Government Shutdown. The survey was sent to about 1,200 Administrator level members of the Sylectus Alliance. Administrators are usually senior people, often owners, of the trucking companies. We received 103 responses in a blind survey.

1. Impact of the shutdown:

The first question was to gauge the impact of the shutdown on their business volumes. About half the companies responding, 49.5 percent said there was no impact. The remaining 50.5 percent experienced various degrees of impact.

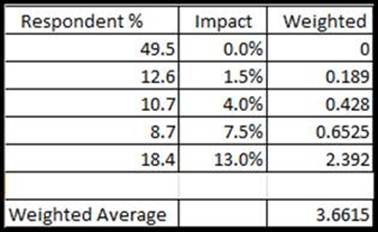

Calculating the weighted average (see calculation table below), this would indicate that the overall impact to be 3.66 percent.

In the table below, I chose the mid-point of the business impact. For example, 1-2 percent is calculated at 1.5 percent. 3-5 percent is calculated at 4 percent, etc.

So, if the weighted average is 3.66 percent, the impact on trucking companies in the alliance seems to be fairly marginal.

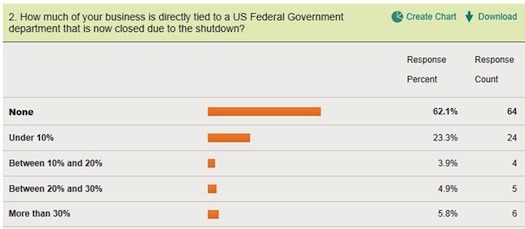

2. How much of the business is directly tied to a department that is shut down:

Not all Federal departments are shut down, so this question is aimed at gauging the amount of business done with the government.

More than 62 percent of the respondents DO NOT do business with the affected federal departments. Considering only 50 percent of respondents are seeing business decreases due to the shutdown, this number seems a bit high.

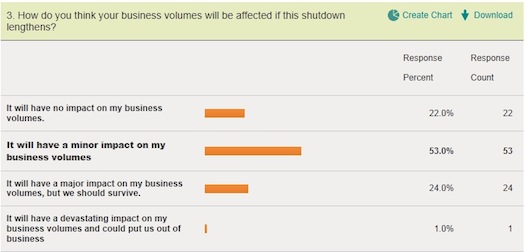

3. What will be the impact if the shutdown continues?

The shutdown will have some immediate effect on shipment volumes, but this question attempts to determine the perceived impact of a protracted shutdown. These numbers become more significant as less than 25 percent of the companies believe it will have no impact on their business, but more than 75 percent believe it will have some impact on their business (either directly or indirectly). One company, in particular, fears it will be put out of business.

Summary of results

In summary, the survey indicates:

The business volume impact is currently minor at about 3.66 percent.

Only about 40 percent of companies are directly affected.

More than 75 percent believe the negative impact will increase as the shutdown lengthens.

About Sylectus

Sylectus is trucking’s most powerful network. Born in the new, cloud-based economy, it’s built on one simple idea … leverage the resources of your competitors to achieve extraordinary results for your customers and for your company. Sylectus is more than Transportation Management Software. It’s a web-based, protected, wealth creation network for managing in the New Trucking Economy. Designed exclusively for progressive trucking companies, Sylectus enables them to bypass the investment and time continuum to grow fast NOW.