In The News

April 2014 Syleconomics - growth still healthy

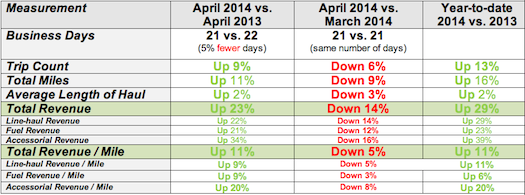

April 2014 vs. April 2013: April 2014, on the heels of a great few months, continued the year-over-year growth momentum. April 2014 had one fewer (5% fewer) business days as April 2013, yet still managed a healthy 23% revenue jump over the same period last year with only a 9% increase in loads. So if we factor in the fewer number of business days, the revenue could have been 25% and loads 10% higher than last year. So April actually saw a continued increase in rates year-over-year. April is typically a slower month than March (see March commentary below), but the year-over-year numbers still showed a healthy growth. All in all, it continues to be a great way to start 2014!

How about capacity? Capacity numbers are showing a relative stability but we have yet to reach 2007 levels, although the truck capacity index hit 98% in April and for the first few days of May we saw it hit 99%. May and June tend to be very busy months in trucking, so we will see how the capacity crunch affects pricing over the next few months.

April 2014 versus March 2014: April 2014 had the same number of business days compared to March 2014, so the data needs no adjustment (note that I already took Easter out of the analysis). April is usually a weaker month compared to March since March is the end of first quarter and is usually a stronger month. This is the first time in a while where there was a strong drop in line-haul rate per mile. It dropped 5% (from $1.81 to $1.72) between March to April. The January-March revenue per mile was buoyed by the driver shortage and severe winter weather that caused disruption in the supply chain. Although the rate/mile had quite a drop from March to April, it is still well ahead of prior year’s rate per mile.

If anything, it is an indicator of how sensitive pricing is to capacity. Once demand dropped a bit in April (like it does almost every year), pricing followed suit. If you look at the rate/mile charts later in this email, you will see an annual trend of rate/mile dropping in April vs. March. I suspect there will be a rebound in the rate/mile number when I publish the May data.

The

year-to-date figures show that 2014 continues on a record start. Total revenues up 29% with business volumes up 13% and rate/mile values all showing strong increases year-over-year. The most important rate, the line-haul rate/mile is up 11% this year vs. last year. We saw a slight dip in rate/mile in April, but once demand picks up, the rate will likely rebound and stabilize. Right now, anyone with capacity and is a quality carrier has an advantage when it comes to pricing.

Capacity continues to lag and has still not reached 2007 levels. Lower capacity will put continued stress on rate per mile. The capacity index started at .94 in early March and is currently at .99, so carriers are slowly adding capacity.

Truck Searches and Load Postings: Both charts show a healthy growth in 2014. The load posting has had a surprising start for the first month of 2014 and continued strong until the slower month of April (which is typical). Again this is reflecting the capacity crunch as companies look for creative ways to cover excess freight.

Below, is a breakdown of the metrics: (Note: To be included in the data analysis, companies had to be on our system for all reporting periods – consider this the “same store†concept)

About Sylectus

Sylectus is trucking’s most powerful network. Born in the new, cloud-based economy, it’s built on one simple idea … leverage the resources of your competitors to achieve extraordinary results for your customers and for your company. Sylectus is more than Transportation Management Software. It’s a web-based, protected, wealth creation network for managing in the New Trucking Economy. Designed exclusively for progressive trucking companies, Sylectus enables them to bypass the investment and time continuum to grow fast NOW.